Futurism Trading is a digital asset management service that seeks lower risk, higher returns.

Futurism Trading achieved a cumulative return of 233.3% from June 2021. Even in a challenging year in 2022, when asset prices plummeted, we recorded an average monthly return of 3%. What's most surprising is that the maximum monthly decline (MDD) was only 2.9%.

* Daily compounded cumulative return in USDT, calculated with reinvestment considered

* Periods prior to incorporation ('22.04) are based on return on equity

Let me introduce how we've been able to achieve remarkable results despite challenging market conditions.

Table of Contents

•

Futurism’s Multi-strategies

Futuristic Trading seeks to be sustainable. It is essential to use a variety of strategies to achieve long-term stability.

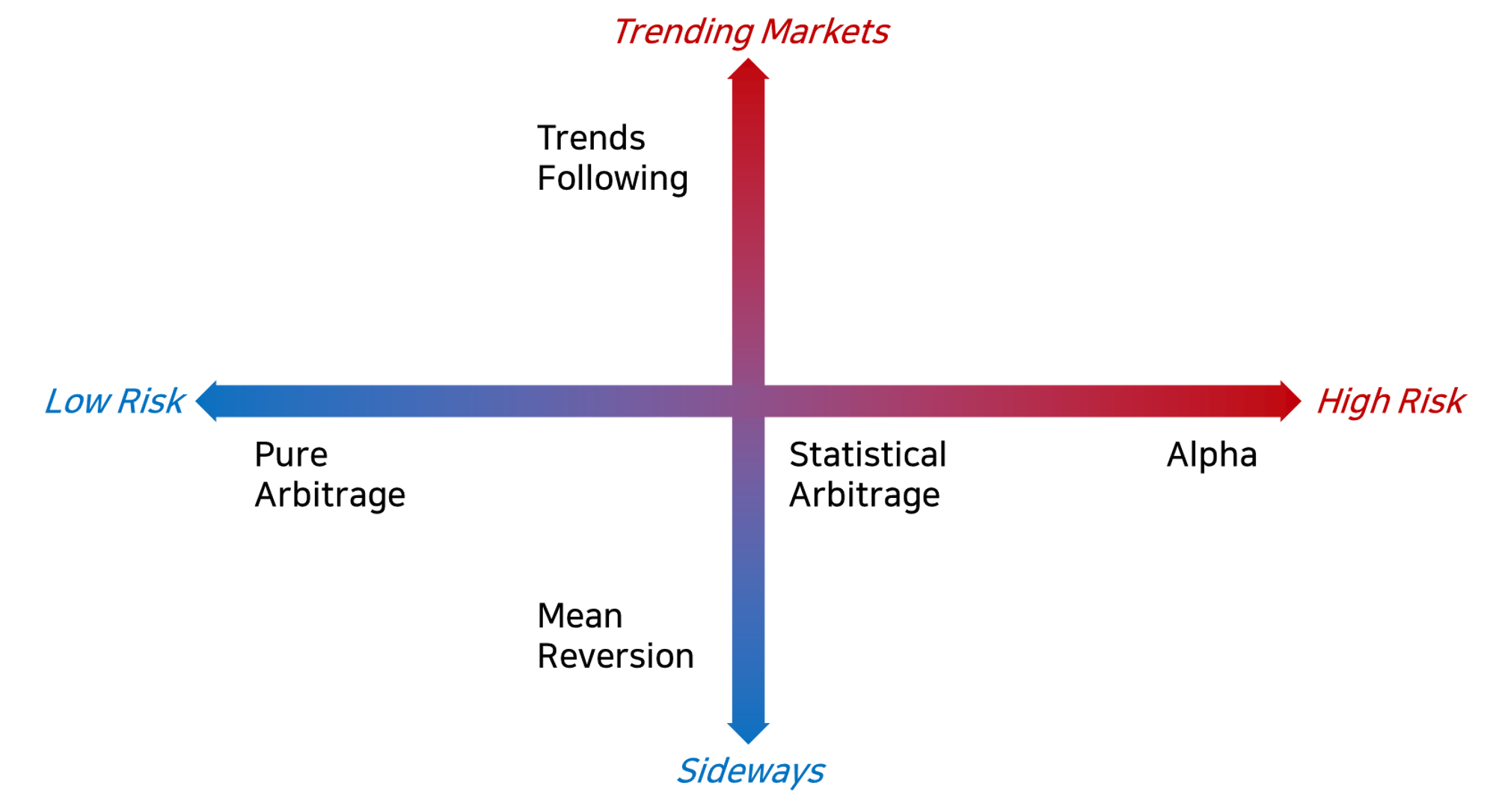

We categorize our strategies into three main groups based on risk level: 1) pure arbitrage, 2) statistical arbitrage, and 3) alpha.

Pure arbitrage strategies can generate steady returns in (almost) any market, but are difficult to fund, while statistical arbitrage and alpha have a higher level of risk, but have the advantage of being able to fund larger than pure arbitrage.

Also, we can categorize strategies according to the market conditions. Generally speaking, markets are divided into "trending" markets, where there is a direction to the price movement, and "sideways" markets, where there is no direction.

In trending markets, trend following style trading is known to work well, while in sideways markets, counter-trend or mean reversion style trading is known to work well.

Therefore, we aim to develop a suite of strategies that can cover a wide range of market scenarios, maximizing the complementarity between them so that they can be profitable no matter how the market flows.

Futurism’s Money Management

The core of Futurism's multi-strategies approach is the money management technique. This can be broken down into two parts: 1) the macro allocation of funds between strategies, and 2) the micro allocation of funds within strategies. As mentioned above, Futurism Trading develops multiple strategies to cover all market conditions.

Therefore, it's important to be able to recognize where the market is at so that you can adjust the allocation of funds between strategies. For example, if we believe the market is in a sideways, we might decrease the allocation of trend-following strategies and increase the allocation of mean-reverting strategies.

The allocation of funds within strategies is a bit of a dry topic, so I'll replace it with a column below. The following technique is one that we're currently adapting and applying to our strategies.

Check out our newest contents

FAQ

Q. Will Futurism Trading always make money without losing?

•

In a sideways market where the trend has stopped, returns can be limited. However, Futurism's money management techniques allow us to maintain lower drawdown, and we react by minimizing our betting size until the market condition allow us to gain statistical advantages.

Q. What makes Futurism Trading different from other crypto-asset managers?

1.

Trading team with an understanding of STOA financial techniques and systems

•

Our team is composed of people from the traditional financial sector (investment bank, asset management firm, and prop-trading firm), and we believe that our thorough risk management is what sets us apart from other crypto-asset managers, as we prevent mishaps in the crypto-market that can occur due to a lack of understanding of the financial system.

•

Our traders are veteran who have traded equities and derivatives (futures, options, ELW, etc.) in the traditional markets. You can read more about their backgrounds on the Futurism official website.

2.

Harmony of technologies and heuristics: semi-automated trading system (Check out Futurism Data Service)

•

We firmly believe trading and driving as similar: just as fully autonomous driving is not yet a reality, so is fully automated trading.

◦

AI technology works best when it learns a pattern and then repeats that pattern over and over again, but in driving and operations, it can't learn every pattern and it doesn't repeat itself.

◦

Even Tesla had over 5 billion miles of training data for fully autonomous driving, but its accidents came from untrained data.

◦

It's the same thing with markets: what we call "fat tails", statistically rare events, happens with a pretty high probability. There's nothing to say that things like the ‘FTX bankruptcy’ or the ‘LUNA crisis’ won't happen in near future, even though they're very unlikely in terms of probability.

•

We use trading algorithms and machines in an auxiliary role, which is why also actively do "manual trading".

◦

In addition, we try to avoid taking positions in situations that cannot be monitored by human traders. If we have an important event in the midnight and the market can change rapidly, we (naturally) take turns monitoring the market and reacting to market conditions in real time.

◦

In the end, it's the human traders who decide what strategy to use in the current market and how to allocate funds. It is a clear difference from the others that the algorithm's parameters are constantly adjusted by the human traders to the market conditions.